If you want to find deals and raise money for them so you can start your real estate development business, then learning how to conduct due diligence so you can pitch your deals better to investors is a great place to start. Any foreclosures are going to be processed through the courts so checking public databases distress sale means on notices of defaults is a great way to get ahead of that curve. An NOD is a notice lenders must file to start the foreclosure process and is the first signal that something is amiss with a property. You can also keep an eye out for bankruptcy filings and then drill down on the various parties in those.

A Guide To Buying And Selling Delinquent Office Space – Bisnow

A Guide To Buying And Selling Delinquent Office Space.

Posted: Tue, 30 May 2023 07:00:00 GMT [source]

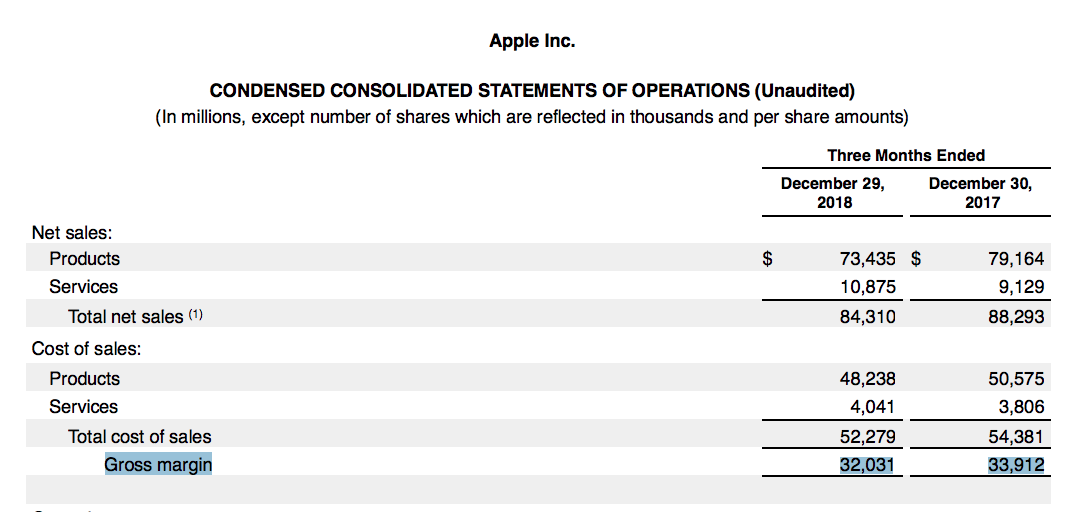

Using the income generated or available from an asset, you can measure its value outside of a pre-existing market. Under the income stream method, you calculate the expected profit of the asset over its foreseeable lifespan and then discount that amount by the time value of money. This is also known as the net present value, because it measures not just the income of the asset, but by discounting it by the time value of money, it inherently measures the cost of holding this asset as inflation occurs over time. There are many other valuation methods, such as the internal rate of return, the price to earnings or P/E ratio, the liquidation method, discounted cash flow method and many others.

A distressed property is a home on the brink of foreclosure or already owned by the bank. Investors often seek these properties out because of the opportunity to buy a home at a discount. A lender may allow the asset owner to pursue a distressed sale if he/she has encountered at least one of the below hardships that have caused the owner to not meet the mortgage obligations. The most obvious disadvantage of a distressed sale is that you are selling off property for less than its full value. Not only that, but you’re also missing out on potential future gains if the property’s value goes up.

How Distress Sales Work

The nice thing about the information you’ll get from a planning office is that it will be information rich with contractor names, architects, engineers etc., all of whom you can contact to further expand your search for deals to buy. There are many ways to find distressed properties, particularly as technology has become more advanced. There are more software programs than ever before available to assist you in your search. Now, prospective investors can use robust databases of public and private data combined with sophisticated algorithms to spot when a property is on the brink of becoming distressed – even before it is technically classified as so. The second debt category, equipment debt, is almost as easy to search for as real estate debt.

A distressed sale may appear to be a viable option for some people, but it can also be unsettling. Before making a purchase, you should thoroughly research the product and be aware of the risks. Many distressed houses are the result of foreclosures or pre-foreclosures.

How do I determine the value of the equity in a company when there is no market?

Distress sales often result in a financial loss for the seller who, for reasons of economic duress, must accept a lower price. The proceeds from these assets are most often used to pay debts or medical expenses or for other emergencies. Many investors will rely on tried and true techniques for finding distressed properties, such as leads curated by brokers and lenders. A more sophisticated play may involve buying the senior loan on a property that is in default from the original lender; the bank. This puts the buyer in the position of lender (not owner, yet, of the property), allowing them to pursue any number of collection strategies including foreclosure. More experienced investors will find that buying commercial real estate and recapitalizing it is also highly attractive.

Additionally, there could be unsecured debt affecting the business that you are buying. Unlike real estate and equipment, which are normally only affected by debts specifically against those assets, a business can have a number of creditors who have never filed a searchable lien. For instance, a company could have a credit card with hundreds of thousands of dollars of debt unbeknownst to anyone except the business and that creditor. If that business is purchased, the buyer would own the business and could be subject to the paying back the debt.

How real estate investors are leveraging on distress sale

When most people think of “distressed real estate,” they think of a property in failing physical condition. Imagine properties where the roof has caved in or a leak has caused widespread damage. Step 1 in the D.O.V. Method is Debt, meaning you must figure out what debt currently encumbers the asset. For instance, is there a bank loan or I.R.S. lien affecting the individual asset or is the company or person who owns the asset affected generally by an overriding debt or lien?

The seller might request offers by advertising the item or instead might offer the item to a pawnbroker. And in most cases, individuals who opt for a short sale can apply for a reasonable mortgage rate within months. Meanwhile, people who go into foreclosure usually have to wait several years.

Even if you do get the opportunity to explore the property, the seller doesn’t have any money. Prospective home buyers are often looking for bargains, particularly in seller’s markets. The content provided here is for informational purposes only and should not be construed as legal advice on any subject.

Advantages of Buying a Distressed Property

The third debt category, debt affecting equity in a company, is the hardest type of debt to search. Most creditors will file a UCC lien against a business or its owners when they claim a lien on equity interests, just like equipment. In that case, you can follow the same steps mentioned above regarding searching for debt on equipment.

A durable equity rally faces strengthening headwinds – RBC Wealth Management

A durable equity rally faces strengthening headwinds.

Posted: Wed, 02 Aug 2023 21:22:30 GMT [source]

In cases like these, the owner is typically facing some sort of financial hardship. The tools historically used by investors are rapidly evolving as technology and predictive analytics become more advanced. In this article, we look at the top tricks for finding distressed real estate for sale regardless of asset class or location. In distressed situations creditors often initiate the sale process, as lenders seek to liquidate their claims in a struggling company that represents a deteriorating credit.

The amount of the cancelled balance may be taxable if the owner’s mortgage agreement holds them liable for the full loan amount. You’ve already got some momentum; now start finding and educating prospects about what you’re doing so you can build an email list of people to pitch to when you’re ready to raise money for your next deal. An investor will also want to carefully consider underlying market conditions. A well-located property in a financially distressed situation could be an excellent buy for a savvy investor. Meanwhile, if a property has fallen into distress because of weakening market conditions, this is a red flag that should serve as caution to investors.

If careful attention is not paid to this determination, the creditor that owns the debt might very well have superior rights to the asset. There can be many causes of a distress sale, but some of the most common include financial difficulties, the need to relocate, or health problems. In a distress sale, the seller is usually motivated by the need to sell quickly, rather than by getting the highest possible price. This can often lead to a lower sales price, as the seller may be more willing to negotiate. Many investors buy distressed properties and fix them up, only to either flip the house or rent it out.

Most importantly, you will need to have your capital in place – meaning cash – and be ready to act with blistering speed to conclude a deal. Maybe an architect hasn’t been paid and is will to share with you information about a deal that has gone south on the presumption you’ll hire them to keep the thing going if you take over. It was really about a niche, a focus on distress opportunities, regardless of the market cycle. Last summer when we launched, I was the oddball at the beach wearing a ski jacket.

Now you are into a building with only $160,000 of equity that has a value of $1.2 million. In this case, a small issue spirals into a bigger problem that the owner may not be able to fix on their own (or may not have the resources to do so, now that it’s a more costly problem). The owner inadvertently put repairs and maintenance on the back burner and as a result, now has a distressed property on their hands. Owners like these will often throw in the towel and opt to sell, given how distracted they are with other things going on in their personal lives.

In real estate, that market exists, and using comparable, recent sales, one can put a relative dollar figure on its value. However, real estate is inherently more or less valuable depending on its location. Real estate also has many environmental issues to be researched or has improvements and leases or entitlements affecting the property. Finally, the potential buyer should review the relevant city and state codes and restrictions to ensure that the proposed or even the current use of the property is allowable. Executing a distressed sale obviously isn’t an ideal situation, but it’s also not the end of the world either (and it’s certainly better than a foreclosure). However, be sure to research your options and evaluate the tax consequences of performing a short sale before signing on the dotted line.

- Learn what influences taxes and insurance and how these factors can change your monthly payment.

- Let’s say someone has a $700,000 mortgage on a property assumed to be worth $1 million.

- An NOD is a notice lenders must file to start the foreclosure process and is the first signal that something is amiss with a property.

- Many of the property features, such as appliances and fixtures, are considered functionally obsolete.

Pawnbrokers bid low because they believe they will be able to resell the item for a higher price and make a profit. When you buy distressed properties, you are more likely to get a good deal because the value of the property has dropped. A distress sale, also known as a forced sale or a distressed sale, is a situation in which a seller is compelled to sell their property or goods quickly and at a lower price than market value.

Be ready to sign confidentiality agreements and, as indicated repeatedly in this article, ensure your counterpart at the bank that you can process your own due diligence quickly and have the cash to close. Here’s a rundown of the most popular ways to find distressed properties in 2020. Another form of physical distress is when a building is found to contain hazardous materials. For example, a building that has stood for years and is now undergoing renovations may be found to contain asbestos that had not previously been known to exist. This can add a significant line item to renovation costs that had not been anticipated.